NSW looking to abolish Stamp Duty

RBA Cash Decision November 2020

November 2, 2020

Getting an Australian mortgage whilst living overseas during COVID

January 24, 2021In the latest NSW 2020/2021 budget, NSW treasury announced sweeping changes to the Stamp Duty tax regime.

The proposal is currently light on detail and will go through a period of consultation. Allowing the public and stakeholders to make submissions and comment on the proposal.

What do we know so far?

First Home Buyers

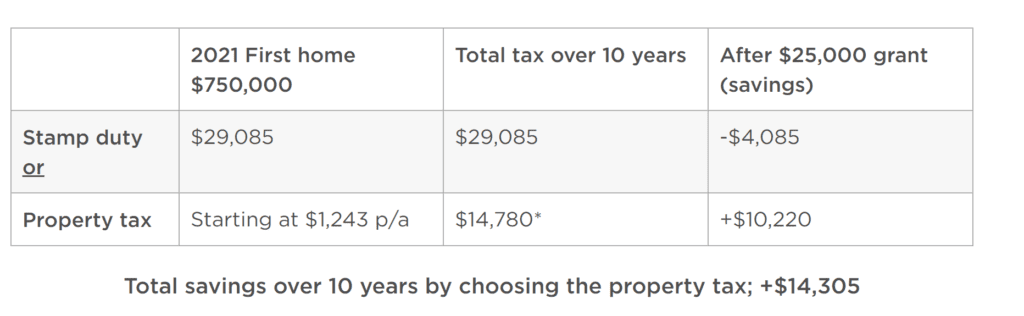

First home buyers, that have a budget of $750,000 and will upgrade to a larger home in the coming years as their family grows. When buying their new home, they would be able to choose to pay the once-off stamp duty or the proposed annual property tax. As eligible first home buyers, they could also receive a $25,000 grant to spend as they wish.

The details on the grant are light, but this could be used against the Stamp Duty charged.

This will provide First Home Buyers, more flexibility as they seek to move and upgrade their family home. By removing the Stamp Duty costs upfront, families will be able to move as their job and family needs evolve.

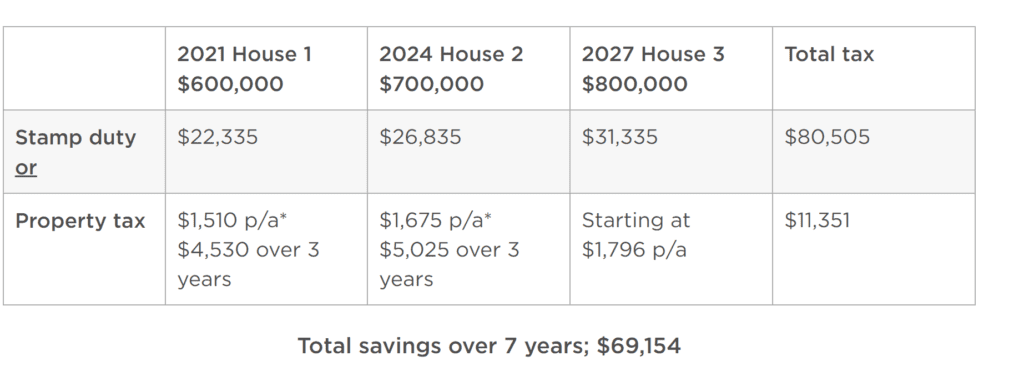

Upgrading home purchase

By electing for the annual property tax, families to choose to pay the annual property tax save $69,154 over seven years under the proposed new scheme. Allowing families to save more money, as they move for family and job reasons.

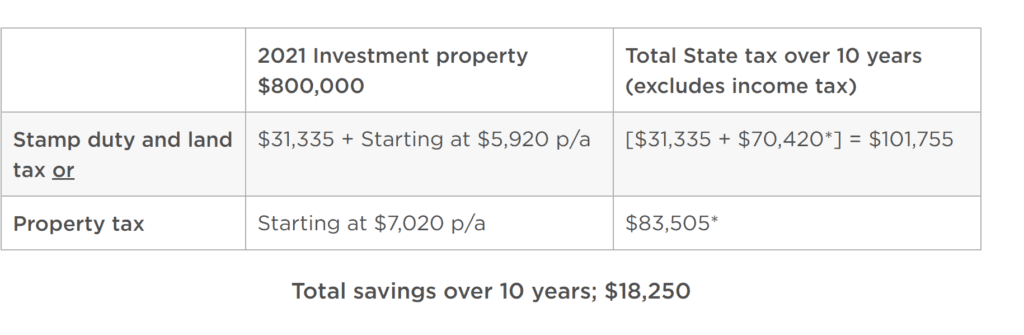

Property Investors

In this example, investors choose to pay the annual property tax and save $18,250 over 10 years under the proposed changes. They would also benefit from deducting property tax from their income tax, as an ongoing tax payment instead of the upfront Stamp Duty.

These proposed changes, will see a higher turnover of housing stock in NSW, which is a great benefit for home buyers, sellers and associated businesses. Which will in term benefit the people and government of NSW. This tax reform will bring the tax regime in line with modern day home ownership.

If you woud like to discuss how these changes impact you, contract us.

Jeremy Harper is the director of hfinance. hfinance is a mortgage brokering business, to speak with a Sydney Mortgage Broker, Gold Coast Mortgage Broker or an Australian expat mortgage broker. Contact by calling us on 1300 928 227 or email info@hfinance.com.au