Australian Budget 2020: What is in it for me?

A suburb in the spotlight: Petersham Property

October 5, 2020

A suburb in the spotlight: Burleigh Heads

October 16, 2020The government has handed down the budget 2020 and not surprising to anyone, this budget was about spending and providing support to the recovering Australian economy from the Corona Virus. Forward estimates, have debt peaking at nearly 1 trillion dollars, but what does all this spending mean for me?

Unemployment per treasury is expected to peak by 8% December 2020, so this budget was able getting people into work and getting people and businesses spending.

Like a kid before Christmas, I am a little excited to through some wins for the Australian taxpayer. Here is a list of some key takeaways from the budget. Note this focus is on business, property and taxes.

Personal Tax Cuts

The government is bringing forward the legislated tax cuts from 1 July 2022 to 1 July 2020. That is correct, backdated tax cuts! This is a major announcement of the 2020 budget.

The top threshold of the 19 per cent personal income tax bracket will increase from $37,000 to $45,000. The low-income tax offset (LITO) will increase from $445 to $700. The top threshold of the 32.5 per cent personal income tax bracket will increase from $90,000 to $120,000.

This represents a tax cut of $2,160 for someone with a taxable income of $60,000 (17.8% reduction) and a tax cut of $2,745 (8% reduction) for someone with a taxable income of $120,000. When comparing the 2018 to 2021 income tax years.

What this also represents is additional borrowing capacity. Let’s take a couple, for example, both applicants with a $90,000 taxable income with 1 dependant, $3,500 monthly living expenses and $6,000 credit card limit and looking to purchase an owner-occupied property.

Currently, their borrowing capacity sits at $1,300,000, with the additional tax cuts that will increase borrowing capacity to $1,400,000 or an additional 7.5%.

Instant Asset Write Off – Business

Small to large business (with an aggregated turnover of less than $5 billion) can deduct the full cost of assets purchased within the business.

This measure will allow businesses to claim the deduction on their company tax, as opposed to depreciating the asset over many years. This deduction will give the business the confidence to invest in their business, to help fuel growth and consumption.

Supporting First Home Buyers

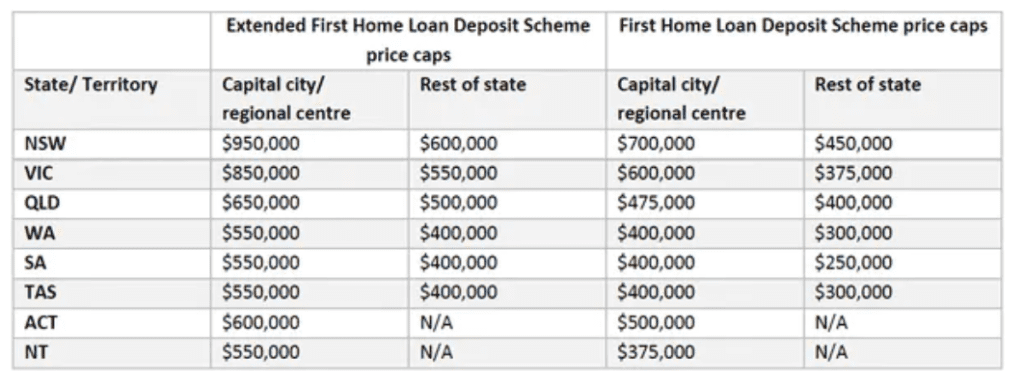

As part of the 2020 budget, the government will make available an additional 10,000 FHLDS places, on top of the existing 20,000 places released this year (10,000 in January 2020 and 10,000 in July 2020).

This program, helps first home buyers get into their first property with as little as 5% deposit and save on lenders mortgage insurance (LMI). Saving borrowers $10,000 – $20,000 in insurance for low deposit loans.

This program is available for the purchase of new homes or newly built, in an effort to stimulate the building and traders industry.

JobMaker Hiring Credit

Aimed at younger job seekers (aged 16 – 35). The government will provide a credit to the business, to pay the wage of younger employees. The program will last for 12 months and every new job created, the employer will receive

- $200 a week if the eligible young person is 16 to 29

- $100 a week if the eligible young person is aged 30 to 35

To be eligible the young job seeker will have received JobSeeker Payment, Youth Allowance (Other) or Parenting Payment for at least one of the three previous months at the time of hiring.

This is estimated to create 450,000 positions for young people and drag down peak unemployment, estimated at 8%.

Consumer Credit Reforms

The government will overhaul the responsible lending obligations (RLOs), to assist in the flow of credit in a bid to help recover the economy.

One of the key reforms will allow lenders to rely on the information provided by the borrowers. This will make the borrowers accountable for providing accurate information to inform lending decisions, placing the current practice of ‘lender beware’ with a ‘borrower responsibility’ principle.

These changes are subject to the passing of legislation, from 1 March 2021.

CGT Exemption for ‘granny flat’ arrangements

Under the proposed change, Capital Gains Tax (CGT) will not apply to the creation, variation or termination of a granny flat arrangement, when there is a formal written agreement in places. This applies to ‘older Australians or those with a disability’.

This will only apply to those is a family relationship or personal ties. Will commence from 1 July 2021. This measure is to assist in providing alternative accommodation for the elderly or loved ones with a disability.

Summary of the 2020 Budget

These budget announcements, send a strong signal from the Australian government to get out there and stimulate the economy through consumption and new jobs. There is something in this budget for everyone and should form a key piece in driving the Australian economy.

Jeremy Harper is the director of hfinance. hfinance is a mortgage brokering business. To discuss how these changes may impact you. Contact by calling us on 1300 928 227 or email info@hfinance.com.au.